IRS offers free electronic filing service ahead of Tax Day (hawaiinewsnow.com)

Economic Update Q1 2022

Economic Update Q1 2022

The General Economy

The economy in the first quarter of 2022 was battered by many forces, from a surge in COVID cases to disruptive weather and then the shock of the war in Ukraine. The latter jolted gas prices and fueled inflation further; the Consumer Price Index (CPI) hit a 40-year high in February at a 7.9 percent annualized rate. Inflation was wide-ranging, reflected not only in gas, food and shelter prices, but also clothing and recreation items. Broad, prolonged price increases are a particular hazard; they can erode the advances made in incomes.

Average hourly earnings improved dramatically over the last year, but this “nominal” figure does not reflect true purchasing power. When the CPI is considered, the “real” number shows that inflation-adjusted wage growth turned negative. This wallet pinch impacted consumer sentiment. Consequently, economists downgraded their forecasts for annualized Gross Domestic Product (GDP) growth significantly. Fannie Mae now places GDP expansion for the quarter at just 0.8 percent.

Apprehension over rocketing prices and war-exacerbated supply chain issues overshadowed some solid strengths of the economy. The current wave of Omicron ebbed, bolstering personal expenditures on services. The number of people out of work because their employer was impacted by the pandemic dropped by over 60 percent in March. The labor market remained tight; the unemployment rate diminished to 3.6 percent in March. It was business investment, set to expand 8.7 percent, that supplied the vigor for the economy. Companies built inventories and managed to boost industrial production, despite the persistent shortage of key components.

The Real Estate Sector

Residential

The housing market experienced another good quarter, but there were definite signs of moderation. Millennials, who are hitting their first-home buying years, and the strong employment situation supported existing home sales, which remained about 6.2 million units on an annual basis. Fears of future climbing interest rates and escalating home valuations kept sales robust in the traditionally weaker winter buying season.

However, the National Association of REALTORS® (NAR) reported that existing home inventory was in short supply, hitting a record low in January. The pace of starts was hindered by delays in material delivery. In February, of the 407,000 new homes available for sale, only 35,000 were completed. Price appreciation was once again in the double digits. Monthly average mortgage rates climbed significantly to 4.17 percent, up more than 1.0 percent over the quarter, in anticipation of the Federal Reserve’s decision to boost interest rates to fight surging inflation. Consequently, total dollar originations were off nearly 23 percent from last quarter, as refinancings plummeted.

In this environment, concerns over affordability of the housing stock grew. The National Association of Home Builders (NAHB) estimates that in 2022, more than 1.1 million households will be priced out of the market for every 25 basis points added to the mortgage rate of 3.5 percent. There is an inventory squeeze on the lower end of the market, exacerbating the cost pressures. A recent NAR report* stated that there are nearly 411,000 fewer homes available now than before the pandemic for households earning between $75K and $100K. In February, the Federal Housing Finance Agency (FHFA) announced a $1.1B program to support affordable home production. But relief is likely a ways off, given that the private sector has struggled to get houses completed with any swiftness.

Commercial Real Estate

The robust rebound in the commercial real estate market continued into the first quarter of this year; deal volume at $38.5B is up 34 percent over the last year, according to Real Capital Analytics. Transaction prices reached new highs for many sectors in February, propelled by the return of investor participation. Industrial and apartment buildings were once again the stars of the quarter.

March became “the return to the office month” for many companies, with mask mandates lifted across the country. However, managers faced a new challenge: competing with the comforts of home. According to a recent Pew Research survey**, 61 percent of teleworkers are choosing not to go into the workplace, even if it is open. Thus, companies are focusing on space that is enticing, both in regard to health standards and amenities. This emphasis bolstered demand for premium space and properties built in the last five years, according to JLL. Older spaces – whether city or suburban – that could not provide upgraded ventilation, smart office technology, or meet environmental certifications found it a harder market. But renovations to buildings are difficult in a time of construction constraints. The flight to quality may be a nagging concern for owners of outdated office space.

A Glance Forward

When the Russian invasion of Ukraine stole headlines in February, economists lowered their forecasts for the second quarter of 2022. March projections for second quarter GDP growth dropped over a point to 3.1 percent. Consumer spending is expected to falter due to the erosion of real wages and intensified uncertainty in the world. The Federal Reserve (the Fed) signaled multiple rate increases over the course of the next year of at least 0.25 percent each. The words “stagflation” and “soft landing” slipped into economists’ commentaries soon after. Will the Fed’s moves overwhelm the economy into a recession and reverse employment gains, or will they cool it down just enough? It’s too early to tell; it will take several months for the Fed’s actions and the current economic shocks to take effect.

Thus, the annual CPI should moderate only slightly to 7.5 percent, according to Fannie Mae. The spring home buying season is expected to still see its traditional healthy demand and home building but higher mortgage rates (expected to rise another 40 basis points) will most likely temper total homes sales growth.

So, spring may not be as rosy as foreseen just in February. However, unlike decades ago when oil prices were skyrocketing and inflation was soaring, the employment situation appears healthy. Both residential and business investment are forecast to swell over 8.0 percent next quarter. As the Chair of the Federal Reserve recently stated, aggregate demand is strong, the labor market is strong, and business and home balance sheets are strong. There is belief that the underlying hardiness of the economy will see us through.

* Copyright ©2022 “February 2022: The ‘Double Trouble’ of the Housing Market.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. April 2022, https://cdn.nar.realtor/sites/default/files/documents/2022-the-double-trouble-of-the-housing-market-02-07-2022.pdf.

** Pew Research Center bears no responsibility for the analyses or interpretations of the data presented here. The opinions expressed herein, including any implications for policy, are those of the author and not of Pew Research Center.

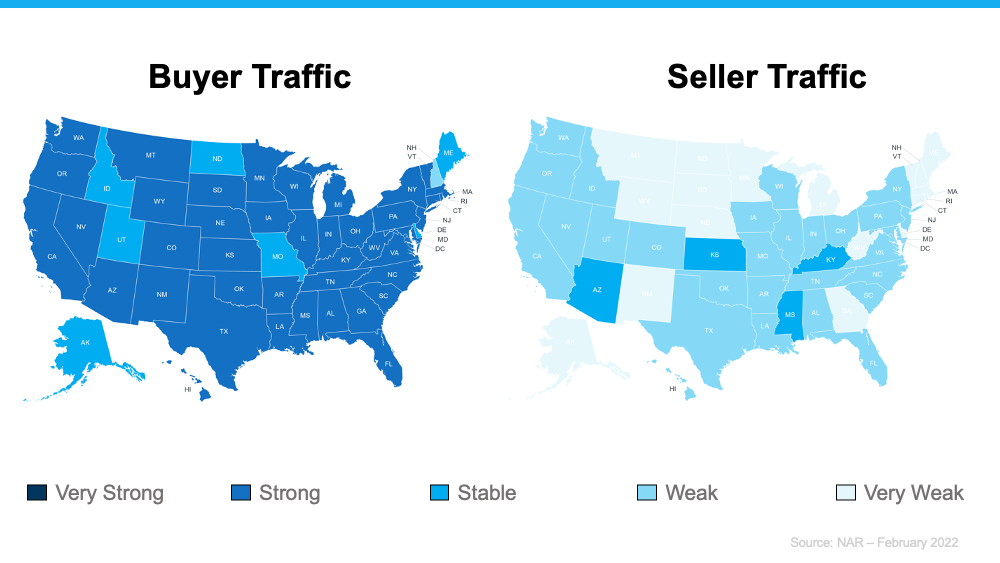

Buyer Demand Strong Throughout USA

On the Fence of Whether or Not To Move This Spring? Consider This.

If you’re thinking of selling your house, it may be because you’ve heard prices are rising, listings are going fast, and sellers are getting multiple offers on their homes. But why are conditions so good for sellers today? And what can you expect when you move? To help answer both of those questions, let’s turn to the data.

Today, there are far more buyers looking for homes than sellers listing their houses. Here are the maps of the latest buyer and seller traffic from the National Association of Realtors (NAR) to help paint the picture of what this looks like:

Notice how much darker the blues are on the left. This shows buyer traffic is strong today. In contrast, the much lighter blues on the right indicate weak or very weak seller traffic. In a nutshell, the demand for homes is significantly greater than what’s available to purchase.

What That Means for You

You have an incredible advantage when you sell your house under these conditions. Since buyer demand is so high at a time when seller traffic is so low, there’s a good chance buyers will be competing for your house.

According to NAR, in February, the average home sold got 4.8 offers. When buyers have to compete with one another like this, they’ll do everything they can to make their offer stand out. This could play to your favor and mean you’ll see things like waived contingencies, offers over asking price, earnest money deposits, and more. Selling when demand is high and supply is low sets you up for a big win.

If you’re also looking to buy a house, you may be tempted to focus more on just the seller traffic map and wonder if it means you’ll have trouble finding your next home. But remember this: perspective is key. As Danielle Hale, Chief Economist at realtor.com, says:

“The limited number of homes for sale is a lesson in perspective. This same stat that frustrates would-be homebuyers also means that today’s home sellers enjoy more limited competition than last year’s home sellers.”

If you look at the big picture, the opportunity you have as a seller today is unprecedented. Last year was a hot sellers’ market. This year, inventory is even lower, and that means an even bigger opportunity for you. Even though finding your next home in a market with low inventory can be challenging, is that concern worth passing on some of the best conditions sellers have ever seen?

As added peace of mind, remember real estate professionals have been juggling this imbalance of supply and demand for nearly two years, and they know how to help both buyers and sellers find success when they move. A skilled agent can help you capitalize on the great opportunity you have as a seller today and guide you through the buying process until you find the perfect place to call your next home.

Bottom Line

If you’re ready to move, you have an incredible opportunity in front of you today. Trust the experts. Let’s connect so you have expertise on your side that can help you win when you sell and when you buy.

Governor Ige Releases 6 Million for Maui Projects

“The Maui News

Gov. David Ige has released more than $6 million to fund capital improvement projects for Maui County.

The funds were released in February and March, according to a news release from the Governor’s Office on Tuesday. They include:

• $3 million to finance the design of ticket lobby improvements at Kahului Airport. Estimated completion is September 2023.

• $1.483 million to provide additional construction funds for the new medium security housing unit at Maui Community Correctional Center. Total project cost is $16.359 million. Estimated completion is April 2023.

• $1.293 million to finance land acquisition, design and construction for guardrail and shoulder improvements at various locations on state highways on Maui. Total project cost is $6.465 million. Completion dates vary.

• $250,000 to Hana Health for construction of the Hana Health Rehabilitation and Support Center. Total project cost is $5.2 million. Estimate completion is December 2023.

Ige also released funds for statewide projects such as highway safety and installation of wastewater and water treatment systems.

“These investments in communities around the state provide the best and most direct way to drive our economy and create jobs for our people, and they help to improve the daily experience of our residents and those who visit Hawaii,” Ige said.”

Hawaii Some Bills That Just Passed the Senate

“The Maui News

The Hawaii State Senate passed more than 120 bills on third reading on Tuesday, including measures aimed at raising the minimum wage, extending the earned income tax credit and establishing an oversight body for Mauna Kea.

“As we begin to prepare for conference committees, the Senate looks forward to working with our House colleagues to find common ground and produce legislation that will benefit the people of Hawaii,” Senate President Ronald Kouchi of Kauai said in a news release Tuesday.

Bills passed include:

• House Bill 510, which makes the state earned income tax credit refundable and extends the availability of the tax credit for an additional six years.

• House Bill 2024, which establishes the Mauna Kea Stewardship and Oversight Authority as a joint authority with the University of Hawaii. It defines astronomy research lands under UH’s jurisdiction and conservation lands under the authority’s jurisdiction and requires both organizations to manage land uses, human activities, access, stewardship, education, research, disposition and overall operations on their respective lands.

• House Bill 2510, which increases the state’s minimum wage incrementally to $12.00 per hour beginning Oct. 1; $15.00 per hour beginning Jan. 1, 2024; and $18.00 per hour beginning Jan. 1, 2026. It also reduces the tip credit to 35 cents per hour beginning Oct. 1 and zero cents per hour beginning Jan. 1, 2026.

• House Bill 1570, which bans the sale of flavored tobacco products and mislabeled e-liquid products. It also establishes fines of up to $500 for violating the law and up to $2,000 for subsequent violations.

• House Bill 2233, which authorizes the Department of Human Services to provide additional housing assistance subsidies of up to $500 per month to Temporary Assistance for Needy Families and Temporary Assistance for Other Needy Families program participants who are participating in the First-To-Work program.

The Senate also voted on House Bill 1600, which appropriates funds for the operating costs of the executive branch for the supplemental budget period beginning July 1 and ending June 30, 2023. Senate Draft 2 of the measure would allocate nearly $8.8 billion for fiscal year 2022 and close to $9.3 billion in fiscal year 2023.”

What is Equity?

Do You Know How Much Equity You Have in Your Home?

![Do You Know How Much Equity You Have in Your Home? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/04/05162315/20220408-MEM-1046x2334.png)

Some Highlights

- If you’re a homeowner, your net worth has gotten a big boost. That’s because recent home price appreciation has increased your equity.

- Your equity grows as you pay down your loan and as your home increases in value. Over the past year, the average homeowner’s equity grew by $55,300.

- Ready to sell? Let’s connect to talk about how you can use that equity to fuel your next move.

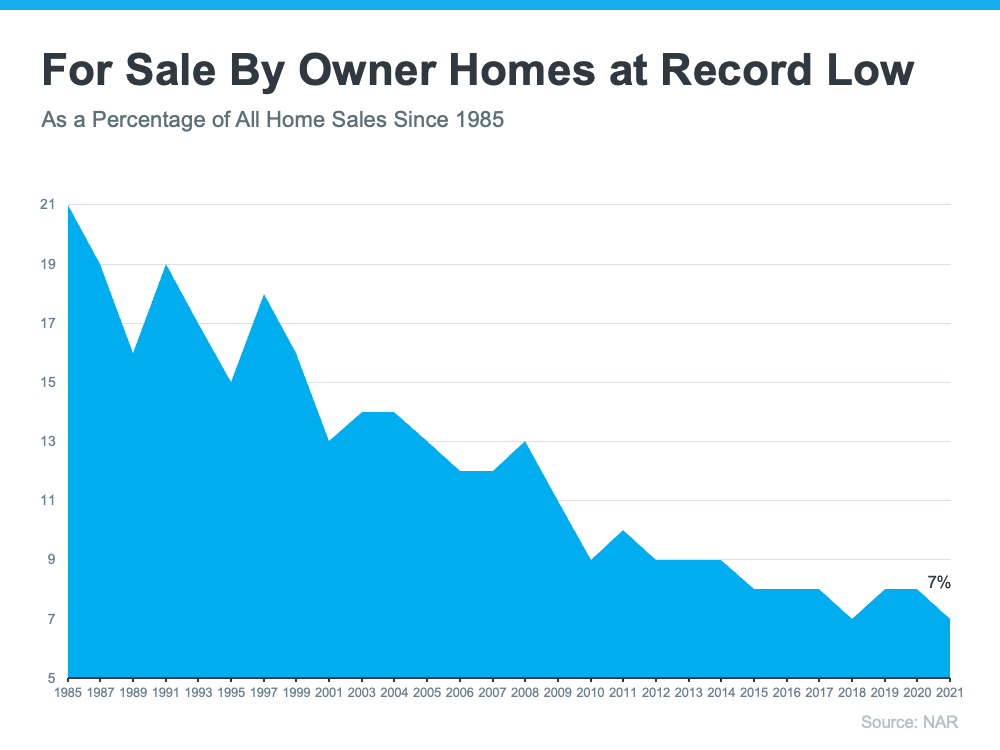

Why A Real Estate Professional Is Key When Selling Your Property

Why a Real Estate Professional Is Key When Selling Your Property

With today’s real estate market moving as fast as it is, working with a real estate professional is more essential than ever. They have the skills, experience, and expertise it takes to navigate the highly detailed and involved process of selling a home. That may be why the percentage of people who list their houses on their own, known as a FSBO or For Sale By Owner, has reached its lowest point since 1985 (see graph below):

Here are five reasons why selling with a real estate professional makes more sense, even in today’s hot market:

1. They Know What Buyers Want To See

Before you decide which projects and repairs to take on, connect with a real estate professional. They have first-hand experience with today’s buyers, what they expect, and what you need to do to make sure your house shows well.

If you don’t lean on their expertise, you may spend your time and money on something that isn’t essential. That’s because, in today’s low-inventory market, buyers are willing to take on more of the renovation work themselves. A survey from Freddie Mac finds that:

“. . . nearly two-in-five potential homebuyers would consider purchasing a home requiring renovations.”

A professional can help you decide what you need to tackle. It’s not canned advice you could find online – it’s recommendations specific to your house and your area.

2. They Help Maximize Your Buyer Pool

Today, the average home is getting 4.8 offers per sale according to recent data from the National Association of Realtors (NAR), and that competition is pushing prices up. While that’s promising for you as a seller, it’s important to understand your agent’s role in bringing buyers in.

Real estate professionals have an assortment of tools at their disposal, such as social media followers, agency resources, and the MLS to ensure your house is viewed by the most buyers. According to realtor.com:

“Only licensed real estate agents can list homes on the MLS, which is a one-stop online shop of sorts for getting a house seen by thousands of agents and home buyers. . . . This is certainly one of many good reasons why the majority of home sellers decide to employ the services of a listing agent rather than going it alone.”

Without access to these tools, your buyer pool is limited. And you want more buyers to view your house since buyer competition can drive your final sales price higher.

3. They Understand the Fine Print

Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. That’s why Investopedia says:

“One of the biggest risks of FSBO is not having the experience or expertise to navigate all of the legal and regulatory requirements that come with selling a home.”

A real estate professional knows exactly what needs to happen, what all the paperwork means, and how to work through it efficiently. They’ll help you review the documents and avoid any costly missteps that could occur if you try to handle them on your own.

4. They’re Trained Negotiators

If you sell without a professional, you’ll also be solely responsible for all the negotiations. That means you’ll have to coordinate with:

- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Instead of going toe-to-toe with all these parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion.

5. They Know How To Set the Right Price for Your House

If you sell your house on your own, you may over or undershoot your asking price. That could mean you’ll leave money on the table because you priced it too low or your house will sit on the market because you priced it too high. Pricing a house requires expertise. Investopedia explains it like this:

“. . . There is no easy or universal way to determine market value for real estate.”

Real estate professionals know the ins and outs of how to price your house accurately and competitively. To do so, they compare your house to recently sold homes in your area and factor in the current condition of your house. These factors are key to making sure it’s priced to move quickly while still getting you the highest possible final sale price.

Bottom Line

There’s a lot that goes into selling your house. Instead of tackling it alone, let’s connect so you have an expert on your side throughout the entire process.

Maui Real Estate Statistics March 2021 vs. March 2022

See the Maui Real Estate Stats March 2021 vs. March 2022 courtesy of Melissa Salvadore at Old Republic Title and Escrow.

Balancing Your Wants and Needs as a Homebuyer Today

Balancing Your Wants and Needs as a Homebuyer Today

Since the number of homes for sale is low today, it can feel challenging to find one that checks all your boxes. But if you know which features are absolutely essential in your next home and which ones are just nice bonuses, you can land a home that fits your needs.

Danielle Hale, Chief Economist for realtor.com, explains it like this:

“Focus on the goal you set out for yourself, like your list of must-haves and nice-to-haves and your budget, . . . Stick to that. Be persistent.”

So how do you go about creating your list of desired features? The first step is to get pre-approved for your mortgage. Pre-approval helps you better understand your budget, and that plays an important role in how you’ll craft your list. After all, you don’t want to fall in love with a home that’s too far out of reach.

Once you have a good grasp of your budget, you can begin to list all the features of a home you would like. Here’s a great way to think about them before you begin:

- Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle (examples: distance from work or loved ones, number of bedrooms/bathrooms, etc.).

- Nice-To-Haves – These are features that you’d love to have but can live without. Nice-To-Haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of the these, it’s a contender (examples: a second home office, garage, etc.).

- Dream State– This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner (examples: farmhouse sink, multiple walk-in closets, etc.).

Finally, once you’ve created your list and categorized it in a way that works for you, discuss it with your real estate advisor. They’ll be able to help you refine the list further, coach you through the best way to stick to it, and find a home in your area that meets your needs.

Another tidbit, sometimes what initially seems as a negative ends up being a positive. Example a gulch on the property can ensure a view plane since no one build in it, a buffer from other properties, and if it isn’t too deep sometimes the slope banks can be planted. There is fencing with posts and wire too for safety that is also see through.

Bottom Line

Crafting your home search checklist may seem like a small task, but it can save you time and money. It’s also one of the keys to being successful in today’s competitive market. Let’s connect so we can work together to find a home that fits your wants and needs.

The Future of Home Price Appreciation ad What It Means For You

The Future of Home Price Appreciation and What It Means for You

Many consumers are wondering what will happen with home values over the next few years. Some are concerned that the recent run-up in home prices will lead to a situation similar to the housing crash 15 years ago.

However, experts say the market is totally different today. For example, Odeta Kushi, Deputy Chief Economist at First American, tweeted just last week on this issue:

“. . . We do need price appreciation to slow today (it’s not sustainable over the long run) but high price growth today is supported by fundamentals- short supply, lower rates & demographic demand. And we are in a much different & safer space: better credit quality, low DTI [Debt-To-Income] & tons of equity. Hence, a crash in prices is very unlikely.”

Price appreciation will slow from the double-digit levels the market has seen over the last two years. However, experts believe home values will not depreciate (where a home would lose value).

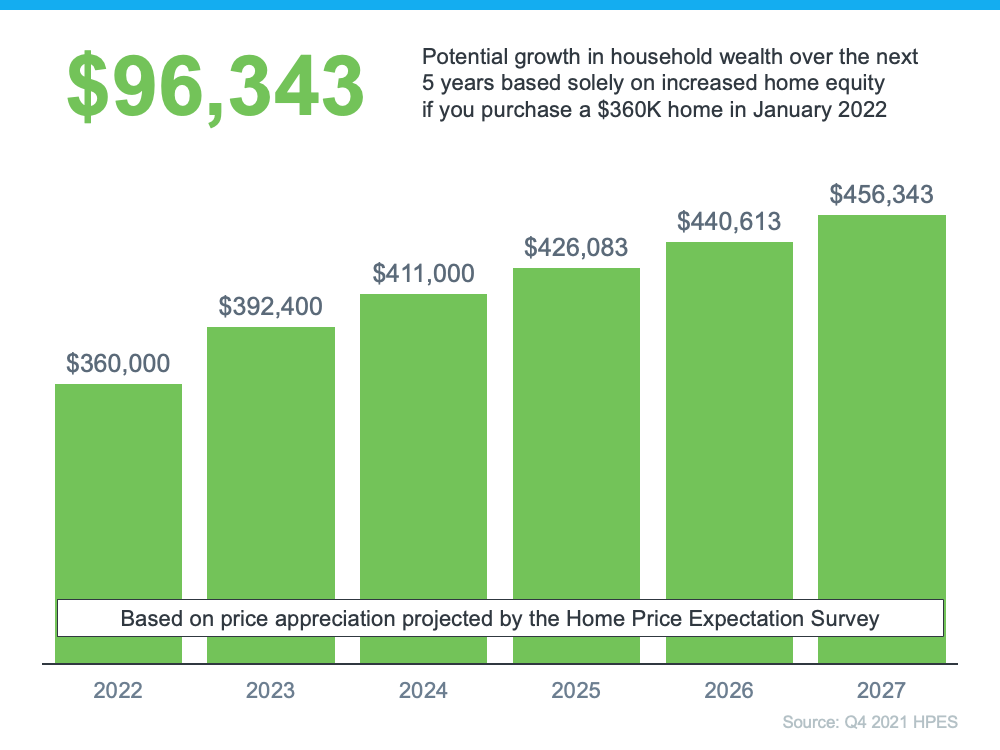

To this point, Pulsenomics just released the latest Home Price Expectation Survey – a survey of a national panel of over 100 economists, real estate experts, and investment and market strategists. It forecasts home prices will continue appreciating over the next five years. Below are the expected year-over-year rates of home price appreciation based on the average of all 100+ projections:

- 2022: 9%

- 2023: 4.74%

- 2024: 3.67%

- 2025: 3.41%

- 2026: 3.57%

Those responding to the survey believe home price appreciation will still be relatively high this year (though half of what it was last year), and then return to more normal levels over the next four years.

What Does This Mean for You as a Buyer?

With a limited supply of homes available for sale and both prices and mortgage rates increasing, it can be a challenging market to navigate as a buyer. But buying a home sooner rather than later does have its benefits. If you wait to buy, you’ll pay more in the future. However, if you buy now, you’ll actually be in the position to make future price increases work for you. Once you buy, those rising home prices will help you build your home’s value, and by extension, your own household wealth through home equity.

As an example, let’s assume you purchased a $360,000 home in January of this year (the median price according to the National Association of Realtors rounded up to the nearest $10K). If you factor in the forecast for appreciation from the Home Price Expectation Survey, you could accumulate over $96,000 in household wealth over the next five years (see graph below):

Bottom Line

If you’re trying to decide whether to buy now or wait, the key is knowing what’s expected to happen with home prices. Experts say prices will continue to climb in the years ahead, just at a slower pace. So, if you’re ready to buy, doing so now may be your best bet for your wallet. It’ll also give you the chance to use the future home price appreciation to build your own net worth through rising equity. If you want to get started, let’s connect today.